If you are a foreign investor interested in company incorporation in Malta, consider the following few details on the approximate money and time required for starting a business in this country.

Cost to Register a Company in Malta

Below is a comprehensive breakdown of how much money you would need to effectively form your company in Malta.

- Registration fee: The standard new company registration fee in Malta payable to the authorities is EUR 245. However, this might vary depending on the chosen share capital amount for the company.

- Minimum Share Capital: The minimum authorised share capital for a private limited liability company is EUR 1,165 of which 20% must be paid up. This makes Malta competitive with its low registration costs. At least two shareholders shall subscribe to the authorised share capital.

This step also requires you to open a bank account. The authorised capital share is equal to the minimum imposed by the law. As aforesaid, it must be fully endorsed in the memorandum. When it exceeds the minimum, at least that minimum shall be endorsed. - Virtual office: It would cost approximately around EUR 125 per month for a virtual office package.

- Physical Office: Depending on the office chose, this package costs EUR 400 – EUR 180.

- Company formation fee: Notably, there might be additional compliance costs depending on the profile of the company. However, our team of experts would be able to provide you with a customised proposal.

- Accounting costs: Starting at EUR 160 per month, maximize bookkeeping, tax advice, and other accounting services.

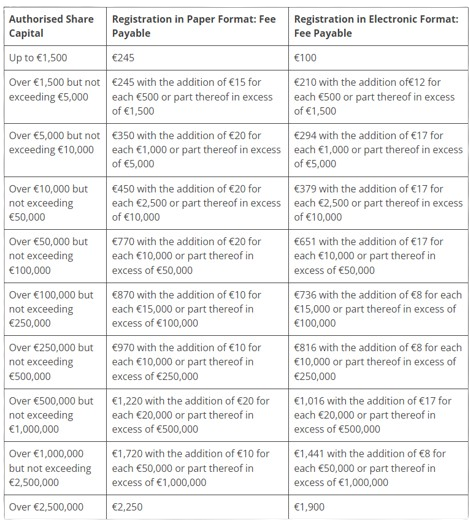

Explore the table below for more details on the registration and fee structure for companies in Malta as stipulated by the Malta Business Registry.

Time required to Set Up a Company in Malta

The time required for incorporating a company in Malta depends on the type of company that is being set up. Generally, the process of setting up a company in Malta can be carried out within a couple of days for EU citizens or companies. Conversely, non-EU companies and citizens may have some restrictions if the company intends to undertake operations directly and exclusively in Malta.

Below is an overview of the various processes involved in setting up a company in Malta and an approximation of how long each would typically take to complete.

- Business name registration takes a few hours;

- Drafting and notarizing incorporation documents takes a day;

- Depositing the share capital takes a day;

- Company and tax registration may take a couple of days;

- VAT registration may take at least a week;

- Obtaining an employer identification number takes at least three days;

- Registration for employment purposes takes two days.

Recent Insights

- A New Era for Caribbean Passports: Navigating Changes and Seeking Schengen Access

- U.S. Gold Card vs. Malta Residency & Citizenship: Which is the Best Investment?

- Can You Lose Your Second Citizenship? Understanding the Risks and Legalities

- Top European Real Estate Markets for Global Investors in 2025

- Building a New Life in Malta: A Guide for UK Non-Doms Relocating to Malta