Forming a new company in Malta involves a series of well-defined steps. Malta's extensive network of double taxation treaties with countries both within and outside the European Union makes it an attractive destination for investments. By choosing Malta, you are committing to start your business in one of Europe’s most dynamic and prosperous economies.

Essentially, Malta has been ranked among the most prosperous countries in the European Union and identified as an advanced economy by the International Monetary Fund, and the World Bank. Therefore, starting a company in Malta has many advantages.

Advantages of Forming a New Company in Malta

Malta’s Tax Regime

Primary among the advantages of forming a new company in Malta is the favorable tax regime that adapts a system of refunds to foreign shareholders depending on the company’s source of income.

A company set up in Malta is usually subject to corporate tax at a flat rate of 35%. Still, the tax refunds system provides 5/7ths, 6/7ths, or 7/7ths back to the shareholders.

By way of example, applying for the 6/7ths refund on the 35% described above would effectively result in a tax to the foreign shareholders of only 5%.

There are also full tax exemptions for holding companies in Malta, and no withholding taxes or stamp duties in profit repatriation.

Low Company Formation and Maintenance Costs

When considering the low company formation and maintenance costs, foreign investors find numerous additional reasons to start a company in Malta. The country's strategic location, combined with its skilled and multilingual workforce, favorable taxation system, thriving tourism sector, and well-developed financial and IT industries, all contribute to its robust economy.

Incentives

Recognizing the importance of foreign investment for economic growth, the Maltese government has designed various programs and schemes that offer tax deductions for foreign entrepreneurs across multiple industries. These incentives facilitate the convenient and effortless establishment of different types of companies in Malta.

Registering a Company in Malta

Foreign investors establishing a business in Malta have to consider the share capital to invest in the company. The Commercial Code only requires private and public companies to deposit a specific amount of funds.

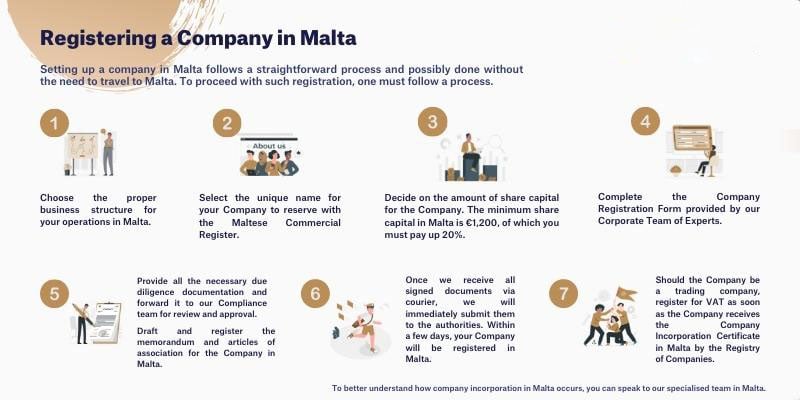

Forming a new company in Malta follows a straightforward process and is possibly done without the need to travel to Malta. To proceed with such registration, one must follow a process.

- Firstly, choose the proper business structure for your operations in Malta.

- Secondly, select the unique name for your Company to reserve with the Maltese Commercial Register.

- Thirdly, decide on the amount of share capital for the Company. The minimum share capital in Malta is €1,200, of which you must pay up 20%.

- Moreover, complete the Company Registration Form provided by our Corporate Team of Experts.

- In addition, provide all the necessary due diligence documentation and forward it to our Compliance team for review and approval.

- Furthermore, draft and register the memorandum and articles of association for the Company in Malta

- Additionally, once we receive all signed documents via courier, we will immediately submit them to the authorities. Within a few days, your Company will be registered in Malta.

- Finally, should the Company be a trading company, register for VAT as soon as the Company receives the Company Incorporation Certificate in Malta by the Registry of Companies.

Recent Insights

- U.S. Gold Card vs. Malta Residency & Citizenship: Which is the Best Investment?

- Can You Lose Your Second Citizenship? Understanding the Risks and Legalities

- Top European Real Estate Markets for Global Investors in 2025

- Building a New Life in Malta: A Guide for UK Non-Doms Relocating to Malta

- Navigating UK Non-Dom Tax Changes: Why the Malta Permanent Residence Programme is the Ideal Solution